Millions of people around the world face a hidden problem in their finances. They have a bank account, but they still cannot fully use the traditional banking system. We call these people underbanked. But what does being underbanked really mean?

If you have a bank account and you are underbanked. Such as a checking account, savings account, or debit card. But still rely on other methods to access and use your money. You may use payday loans, check cashing places, prepaid cards, money orders, pawn shops, rent-to-own stores, or apps like Venmo, Cash App, and PayPal.

People become underbanked for many reasons. Some banks charge high fees. Some areas have few banks and people have a poor credit history or low financial skills. This problem hurts low-income families, people in cities and the countryside, immigrants, and groups with less help in developing countries.

Understanding underbanking is important. It helps people make better financial decisions and improves financial inclusion. In this guide, we will explain:

- The difference between underbanked and unbanked

- Who counts as underbanked

- Why people are underbanked

- How it affects daily life and the economy

- Solutions to move from underbanked to fully banked

Underbanked vs Unbanked

Many people confuse underbanked with unbanked. Here is a simple way to understand it:

| Feature | Unbanked | Underbanked |

|---|---|---|

| Has bank account | ❌ No | ✅ Yes |

| Relies on alternative financial services | ✅ Always | ✅ Often |

| Access to credit | ❌ None | ❌ Limited |

| Examples | People without any checking account | People with a bank account but still using payday loans or prepaid cards |

So, unbanked people have no bank account at all. Underbanked people have accounts but still face barriers to full banking access.

Considered Underbanked

Underbanked people come from many backgrounds. Some common groups are:

- Low-income households – They may not meet minimum balance requirements.

- Gig workers or freelancers – Paychecks are irregular.

- Immigrants – Struggle with documentation requirements.

- Rural communities – Few nearby community banks or ATM access.

- Minority communities – Often face limited financial education and digital divide.

Even with bank account ownership, these people rely on alternative financial services to pay bills or access cash.

Why Do People Become Underbanked?

Several reasons push people toward underbanking:

- High bank fees – Monthly fees, overdraft protection costs, and hidden charges.

- Limited banking access – Few branches, long distances, or poor online banking options.

- Poor credit score – Cannot get loans, credit cards, or mortgages.

- Low financial literacy – Many lack financial education programs to guide them.

- Lack of trust in banks – Past negative experiences make people rely on alternatives.

- Geographic barriers – Rural areas or urban low-income areas may not have nearby banks.

- Digital divide – Limited access to mobile banking and online banking.

Case Study: Maria, a single mother in a rural town, has a checking account but cannot meet her bank’s minimum balance. She uses a prepaid debit card and peer-to-peer payment apps to pay bills. Maria is underbanked.

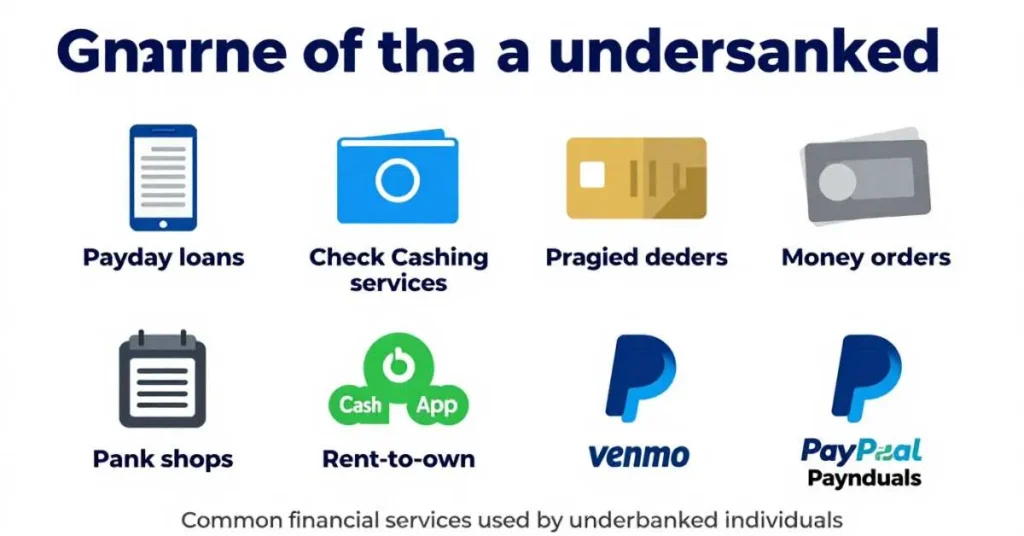

Financial Services Commonly Used by the Underbanked

Even with bank account ownership, underbanked people use:

- Payday loans – Quick cash, very expensive

- Check cashing services – Immediate money but high fees

- Prepaid debit cards – Alternative to debit cards from banks

- Money orders – Pay bills without a bank

- Pawn shops & rent-to-own services – Short-term solutions

- Peer-to-peer apps (Venmo, Cash App, PayPal) – Easy for transfers

- Mobile wallets – Digital access to cash

These services often cost more than traditional banking, creating financial vulnerability.

How Daily Life Is Affected by Being Underbanked

Being underbanked affects:

- Money management – Harder to budget without proper checking accounts or savings accounts

- Financial stability – Higher costs from payday loans or check cashing services

- Credit access – Limited ability to get loans, mortgages, or credit cards

- Stress levels – Constant worry about bills and emergencies

- Long-term planning – Hard to save or invest

Impact Example: John relies on prepaid debit cards for his monthly bills. He pays $50/month in fees he could save if he had a low-fee bank account.

Economic and Social Impact

Underbanking affects communities:

- Income inequality – Money is spent on high-cost services instead of local economy

- Debt cycles – Reliance on payday loans leads to repeated borrowing

- Economic exclusion – Harder for underserved populations to access credit cards, loans, or mortgages

The government and groups like the FDIC, World Bank, and community banks help people use banks. They also make rules to keep people safe from money problems.

Solutions to Underbanking

- Traditional Banking Options

- Low-fee bank accounts

- Credit unions

- Second-chance checking accounts

- Digital and Fintech Solutions

- Mobile banking apps

- Peer-to-peer payment apps

- Mobile wallets

- Digital banking solutions

- Education and Policy Initiatives

- Financial education programs

- Community development programs

- Government financial inclusion initiatives

These solutions help reduce reliance on alternative financial services and improve economic stability.

How to Move From Underbanked to Fully Banked

Step-by-step guidance:

- Assess your financial habits and fees from payday loans or prepaid cards

- Open a low-fee bank account or join a credit union

- Use digital banking solutions and mobile banking apps

- Build your credit score through small loans or credit cards

- Join financial education programs to improve financial literacy

FAQs About Underbanking

Q1: Can a person be underbanked even if they have a bank account?

A: Yes. People are underbanked when they use payday loans, check cashing services, or prepaid debit cards a lot. Even if they have a checking or savings account.

Q2: What causes people to become underbanked?

A: People become underbanked due to high bank fees, limited banking access, poor credit scores, and low financial literacy. These barriers push individuals toward alternative financial services, increasing financial vulnerability.

Q4: Can fintech companies replace traditional banks for the underbanked?

A: No. Fintech companies give easy digital banking tools. They also offer mobile wallets and apps like Venmo or Cash App. But they work with banks and do not replace them.

Q5: How many people are underbanked in the U.S. and worldwide?

A: About 20% of adults in the U.S. are underbanked. Globally, millions of people, especially in developing countries and underserved populations, rely on alternative financial services due to limited banking access.

Final Thoughts

Being underbanked is a big money problem. It hurts low-income households, immigrants, and underserved communities. They have trouble getting loans, credit cards, and savings accounts.

If they use low-fee bank accounts, mobile or online banking. Join financial education programs or government help programs, they can get full access to banks. This helps them save money, spend less on fees, and take part in the economy.

Understanding underbanking helps individuals, communities, and governments work together toward financial empowerment.

Click Here To Read About It: What Does It Means to Be Bipolar: Complete Guide

Hello! I’m Clara Lexis, creator of Meanpedia.com. I specialize in breaking down words, phrases, and idioms so that anyone can understand and enjoy the beauty of English. My goal? Making language approachable, fun, and meaningful, one word at a time.